Medicare. It’s how most seniors get health insurance. But there’s nothing healthy about the frustration, annoyance, and tension you are likely to feel as you try to sort through all the options and find the right Original Medicare or Medicare Advantage coverage for your needs.

What is Medicare and When Do You Sign Up?

Medicare is the federal government health insurance program for people who are 65 and older. Some younger people with certain disabilities are also eligible for Medicare.

If you’ll be turning 65 soon, you need to sign up for Medicare during the time period Medicare calls your Initial Enrollment Period. For most people, that starts 3 months before you turn 65 and ends three months after the month you turn 65. If your birthday falls on the first of the month, however, the enrollment period starts 4 months before you turn 65, and ends 2 months after the month you turn 65.

If you don’t sign up during your initial enrollment period, you are likely be subject to a lifetime late enrollment penalty when you do sign up. The amount of the late enrollment penalty is tied to how late you are in signing up for Medicare.

- If you are still working when you turn 65 and have health insurance through your job, you may still need to sign up for Medicare. That’s because many company health insurance plans make Medicare the primary insurance once you turn 65. See your plan administrator for plan details.

- If you are a Veteran and getting VA healthcare, the Veteran’s Administration recommends that you still sign up for Medicare. Among the reasons, you can be treated at non-VA facilities if needed.

Find more information about the initial enrollment period and when your coverage starts on this Medicare.gov page.

Medicare vs Medicare-Approved Plans

The only health insurance you can buy directly from the government is Original Medicare (Parts A and B). This provides essential health coverage (see below), but the program only pays 80% of covered expenses. The limitations and co-pays can still leave you with big medical bills.

To fill the void, there are various Medicare-approved health insurance plans to help cover costs that Medicare Parts A and B don’t cover. Private insurers are the ones who sell all of those Medicare-approved plans. They come with varying price points, levels of coverage, and benefits. Your choices and pricing for some of the supplemental plans will depend on where you live.

Why Choosing Medicare Health Insurance is Confusing

The way plans are named, and the variety of choices are partly to blame for the difficulty choosing Medicare insurance plans.

For starters, there are two confusingly similar terms: Original Medicare (government insurance) and Medicare Advantage (alternative, Medicare-approved health insurance from private companies.)

Then, you have to slosh through an alphabet soup of Medicare “Parts”. Each part offers different types of coverage.

- Medicare Parts A and B are U.S. government insurance that provide medical and hospital insurance.

- Medicare Part C refers to Medicare Advantage plans, which are alternatives to traditional Medicare. (But to be eligible for a Medicare Advantage plan, you still need to sign up for Medicare.)

- Medicare Part D is prescription drug insurance.

In addition, there’s another part to Medicare that isn’t named “Part”. It’s Medigap insurance (supplemental Medicare insurance). It consists of 10 different plans, each of which are named with an alphabet letter from A to N.

Medicare Parts A and B are the only parts that come from the federal government. All the other plans (i.e, Part D drug insurance, Medigap plans A to N, and Medicare Advantage) are sold by private insurance companies.

Medicare Parts, Options, and Terminology Explained

Here’s an overview of Medicare insurance options that will help you understand what each part covers and what to consider as you decide on the best Medicare option for you.

Original Medicare

Original Medicare, sometimes referred to as traditional Medicare, is the federal government health insurance program. It is made up of Parts A and B. It is offered directly by the federal government.

A big advantage of Original Medicare is that it lets you be treated by any doctor or at any medical facility that accepts Medicare.

Once you sign up, the premiums are deducted from your Social Security check each month. Here are the expenses Medicare Part A and Part B cover:

- Part A: Hospital insurance, covering inpatient hospital stays, skilled nursing facility care, hospice, and some home health care.

- Part B: Medical insurance, covering services like doctor visits, outpatient care, medical supplies, and preventive services.

Medicare Part A is free for most individuals because either they or their spouse have paid Medicare taxes for 10 years or more while they were working.

Medicare Part B is not free. It currently costs $174.70 a month for most people in 2024. That increases to $185 in 2025. The cost goes up with income, however. Your premium will be higher if your modified adjusted gross income, as reported on your IRS tax return from 2 years ago, is more than:

- $103,000 in 2024, if you file an individual tax return or are married and file separately

- $206,000 in 2024, if you are married and file a joint tax return

This Medicare fact sheet includes information about all Part B premium rates.

Supplemental Plans

Medicare pays only 80% of the cost of covered expenses. Fortunately, you can get additional insurance from private insurers to help cover costs that Original Medicare doesn’t pay. Those additional coverages fall into these categories:

- Extra coverage (enhancements) for Original Medicare

- Medicare Advantage insurance, which is an alternative to Original Medicare.

Here’s how each work:

Extra Coverage for Original Medicare

There are two types of Medicare-approved health insurance plans that provide enhanced benefits to help those on Original Medicare pay for non-covered costs. Both types of plans are sold by private insurance companies.

- Part D: Prescription drug insurance is extra insurance to help pay for the cost of medications. It can be purchased by people who have Original Medicare.Here is information describing the major changes in Part D insurance starting in 2025.

- Medigap Insurance (Medicare supplemental insurance): This is extra insurance you can buy to help pay the 20 percent of medical and hospital bills that Original Medicare doesn’t pay.

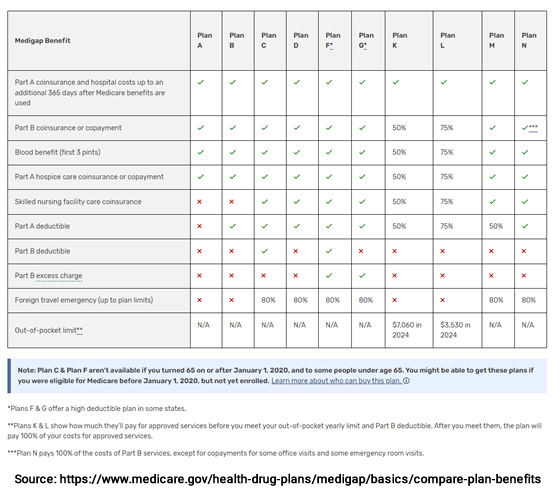

- There are 10 different Medigap plans available in most states.

- The plans are designated by letters from A to N.The benefits and coverage each lettered plan offers are the same no matter what insurance company you buy the plan from.

- However, the pricing can differ from one insurance company to another. Thus, plan G might be sold at one price by one insurer, and a different price by another insurer, but both plans would offer the same benefits.

Here are the different types of Medigap supplemental insurance plans (click the image to see the chart enlarged):

Medicare Advantage Plans – Medicare Part C “Alternative” Insurance

Medicare Advantage plans are Medicare-approved alternatives to Original Medicare, sold by private insurance companies. They are “all-in-one” plans, however, to qualify for a Medicare Advantage plan, you have to sign up for Medicare and pay the Medicare Part B premium. The part B premium is in addition to any premium the Medicare Advantage plan charges.

Like Medigap plans, Medicare Advantage plans reduce your exposure for the 20 percent of costs Medicare Parts A and B don’t cover. Additionally, Medicare Advantage plans usually (but not always) include prescription drug coverage and may include additional benefits such as gym memberships or an allowance for dental or vision expenses.

Although an all-in-one solution sounds ideal, it has its downsides. Among them:

- Medicare Advantage plans are often PPOs or HMOs. This could limit your choice of doctors and other healthcare providers to those who participate in the insurance plan’s network.

- The provider network may be regional, and may not be available in locations you travel to or live in for part of the year (for instance, if you spend winters in a southern state.) If you move to a different location or move in with family members in another state or part of your state, you may need to change your insurance plan.

- Plans may require pre-authorization to see specialists or to have certain procedures. Here’s a comparison of the features of HMOs, PPOs, and some types of Medicare Advantage Plans.

- Depending on the plan you choose and your personal health and preferences, out-of-pocket costs plus premiums may be higher for the year than using Original Medicare and purchasing Part D and Medigap insurance.

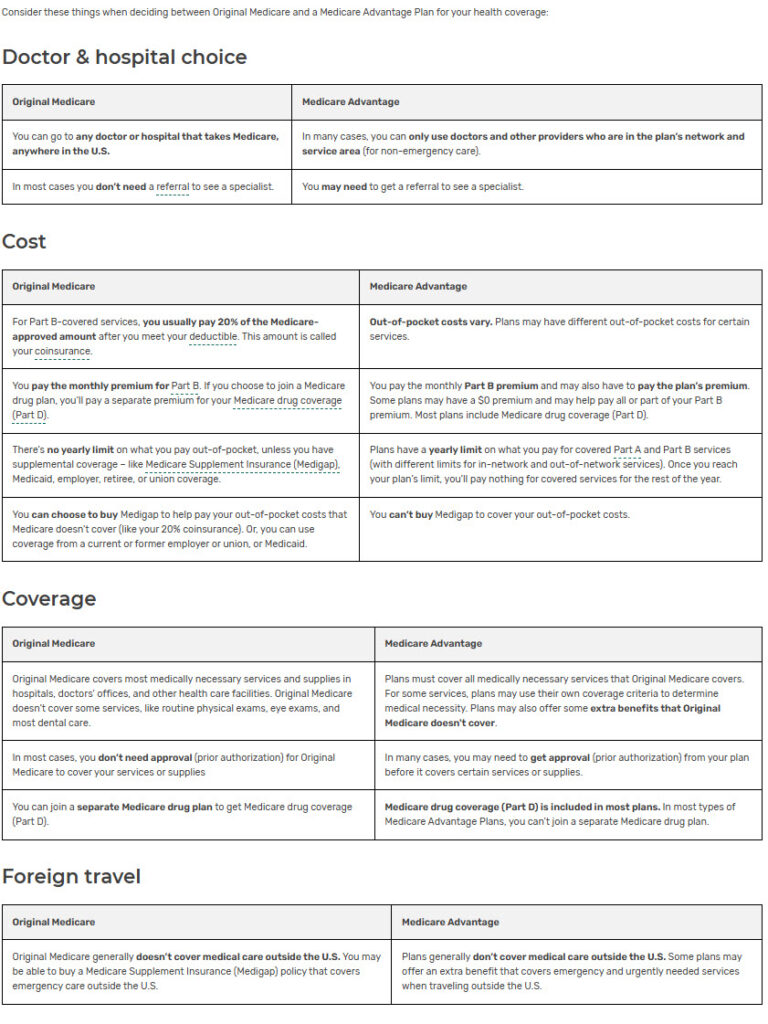

How Original Medicare Compares to Medicare Advantage

This chart from Medicare.gov compares Original Medicare to Medicare Advantage plans. (Click the chart to view it on Medicare’s site).

How to Choose the Right Option for You

Once you understand your options, then it’s time to choose the plan or plans that will work best for you. To make your choice, you’ll want to consider your preferences, your health care needs, and your budget. For help making a decision, see our post on how to choose the best Medicare plan for your needs.

When You Can Switch Plans

You are allowed to switch Medicare plans just once a year during the annual Medicare Open Enrollment Period. That period starts October 15 and ends December 7 each year. People who are already enrolled in a Medicare Advantage Plan have another open enrollment time frame, too. That’s from January 1 through March 31.

You may be able to switch at other times of the year if you move to a new location and your Medicare Advantage plan or Part D plan isn’t available in your new location.

It’s important to carefully consider your needs, since you’ll be stuck with whatever option you choose for a year. That rule is the same whether you choose Original Medicare, plus supplemental Medigap and Part D drug coverage, or a Medicare Advantage plan. Another consideration is that if you start with a Medicare Advantage plan and later want to switch back to Original Medicare, you may have difficulty getting Medigap and Part D coverage.

You Don’t Have to Change Plans Yearly

If you like the plan you have, in most cases you can keep it from year to year unless the insurer stops offering the plan. Your insurer may change the premiums or coverages, for the new year. If they do, they are required to send you an Annual Notice of Change telling you what changes will occur. This Annual Notice of Change is sent in September so you have time to review and compare plans if you want to switch.

Further Reading: Even with Medicare Part D, prescription drugs can be expensive. Here are tips to save money on prescription drugs without skipping doses or doing without.

Top Image source: Dall-e

Disclaimer: The information on this website is provided for informational purposes only and should not be considered as legal, tax, accounting, or medical advice. Please consult a licensed professional for help with any specific questions and issues you may have.

Leave a Comment

Your email address will not be published. Required fields are marked with *