If you have an Original Medicare policy, you probably have heard about the Medicare open enrollment period. That’s the time running from October 15 to December 7 when you can change your Medicare, supplemental Medicare and Medicare Advantage plans. (This article explains the different kinds of Medicare insurance available.)

But if you currently have a Medicare Advantage plan, there’s an additional time when you can make a change: the Medicare Advantage Open Enrollment period. That period runs from January 1 through March 31.

What You Can Do During Medicare Advantage Open Enrollment

During the Medicare Advantage Open Enrollment period you can either:

- Switch from the Medicare Advantage plan you’re on to a different Medicare Advantage plan

Or

- Switch back to original Medicare. Coverage will begin on the first day of the month after you make the switch.

Potential Hazard of Switching Back to Original Medicare

If you want to switch back to Original Medicare during this period, you could be setting yourself up for a big expense. In many cases, Medigap policies (the supplemental insurance that picks up the 20% of covered costs Medicare parts A and B don’t pay) aren’t guaranteed issue in all states. The same is true for Medicare Part D drug plans. Thus, you could be turned down or have to pay much higher premiums for Medigap and Part D due to health issues and preexisting conditions.

Ultimately, whether or not you can qualify for guaranteed issue Medigap will depend on why you’re looking to change plans and where you live.

What If Your Medicare Advantage Plan is Cancelled?

If the insurer cancels or drops your Medicare Advantage Plan and doesn’t offer a similar plan you may be eligible for a guaranteed issue Medigap policy if you switch to Original Medicare. The same is true if you move to a new location that isn’t covered by your current Medicare Advantage plan.

States with Guaranteed Issue Laws

Where you live matters, too. Four states (Connecticut, Maine, Massachusetts, and New York) have guaranteed issue protections for Medigap for all beneficiaries ages 65 and older, regardless of medical history. And thirty-five states require Medigap insurers to issue policies to Medicare beneficiaries ages 65 and older due to certain qualifying events, such as when an applicant has a change in their employer (retiree) coverage.

Laws Regulating Coverage

Under federal law, Medigap insurers in your location can’t turn you down for pre-existing conditions in the first 6 month period that you are eligible to sign up for Medicare.

But after that period, in many cases the law allows Medigap insurers to use medical underwriting to either deny Medicare beneficiaries a policy or charge higher premiums.

According to KFF, an independent source for health policy research, polling, and news, these are just a few of the conditions that could potentially trigger an insurer to deny coverage:

- Alzheimer’s disease

- Asthma

- Cancer

- Congestive heart disease

- Diabetes

- High blood pressure

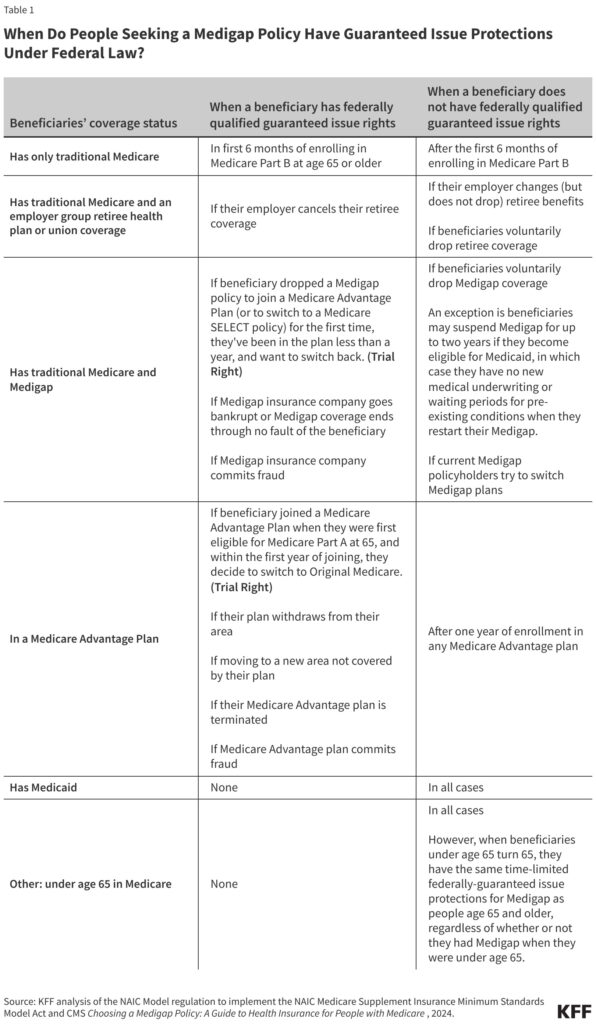

Medigap Guaranteed Issue Protection at a Glance

This chart from KFF shows when people seeking a Medigap plan have guaranteed issue protection under federal law.

Bottom Line:

It’s important to have the best Medicare insurance option available for you. So, If you’re unhappy with your current Medicare Advantage plan, you can switch to a different Medicare Advantage plan during the Medicare Advantage Open Enrollment period that runs from January 1 to 31. But if you want to switch back to Original Medicare, depending on how long you had your Medicare Advantage plan, you may face higher costs of denials for supplemental plans to cover the expense part Medicare Part A and Part B don’t cover.

Thus, before making your decision, it would be wise to contact Medigap insurance providers in your area and ask if you qualify for coverage, and what the cost would be.

Photo source: Istockphoto

Chart: courtesy of KFF

Disclaimer: The information on this website is provided for informational purposes only and should not be considered as legal, tax, accounting, or medical advice. Please consult a licensed professional for help with any specific questions and issues you may have.

Leave a Comment

Your email address will not be published. Required fields are marked with *