Big changes in Medicare Part D (prescription insurance) go into effect in January 2025. The changes may have a significant impact on your costs and prescription drug coverage under your current Medicare Part D plan or your Medicare Advantage plan. That makes it critically important this year to read the Annual Notice of Change that you received from your insurer in September.

Table of contents

- What is the Annual Notice of Change?

- What’s Changing in Medicare Part D Prescription Drug Coverage?

- How the Changes Could Affect Your Part D Coverage

- Get the Best Part D Drug Plan for Your Needs

- 1. Read the Annual Notice of Changes Your Plan Provided

- 2. Review of all the Medications You Take

- 3. Compare Part D 2024 and 2025 Costs

- 4. Review other details if You Have Drug Coverage through a Medicare Advantage Plan

- 5. Compare Your Current Medicare Plan(s) to Others Available to You

- 6. Don’t Procrastinate

- What to Do When Medications Aren’t Covered by Your Plan

- Where to Search for Part D Alternatives

- What Can I Do if I Can’t Afford a Part D Plan

- FAQs

- Are You Required to Sign Up for Medicare Part D?

- Do You Have to Change Medicare Plans Each Year?

- Do I Have to Do Anything To Renew My Current Plan if I Want to Keep It?

- Do I Have to Apply for the $2000 Cap on Out-of-Pocket Medication Costs?

- What is a Formulary?

- What is the Medicare Annual Enrollment Period?

- When is the Medicare Annual Enrollment Period?

- What in the Medicare Annual Notice of Change (ANOC)?

- Why Do I Need to Read the Notice of Change?

- Are There Resources to Help Understand Medicare Part D Plans?

- Stay Informed Every Year

What is the Annual Notice of Change?

The Annual Notice of Change (ANOC) tells you about upcoming changes in prices and coverages for the coming year. It is sent out early enough to let shop around, compare plans, and make a change (if you want to) within the 8-week Medicare Open Enrollment period (October 15 through December 7).

Although there are a few exceptions, those eight weeks are the only time each year that you’re allowed to switch plans. If you miss that deadline to make a change, you’re out of luck. You’ll be stuck for an entire year with whatever changes your current plan makes.

What’s Changing in Medicare Part D Prescription Drug Coverage?

Medicare Part D is the part of Medicare that helps with the cost of prescription medications. It is sold by private insurers. It is included in some Medicare Advantage plans and sold as a separate plan for people with original Medicare and for those whose Medicare Advantage plans don’t include prescription drug coverage.

There are several important changes to the Medicare Part D drug benefit that will go into effect in 2025 and may affect your coverage. These changes are mandated by the Inflation Reduction Act of 2022 .

1. New $2,000 Cap on Drug Costs for Medicare Part D

One big change coming up in 2025 Part D plans is the new, $2,000 cap on out-of-pocket costs for covered medications. (The 2024 cap is $8,000.)

Covered medications are those your plan pays for and lists in its formulary. If a medication is not in the your plan’s formularly, it is not covered and you have to pay the full retail price for the drug.

Here’s how the $2,000 cap on drug expense will work in 2025:

- Once your out-of-pocket costs for covered medications reach $2.000 for the year, you pay nothing additional for any prescribed medications that are covered by your plan.

- Your Medicare Part D premium does not count towards the $2,000 cap.

- Your out-of-pocket expenses for drugs that are not covered by your plan do not count towards the $2,000 cap.

- You are still required to pay the full cost of any necessary medications that your plan does not cover even after you have reached the $2,000 cap.

2. Elimination of the Part D Donut Hole

The “donut hole” (coverage gap) will disappear completely for 2025.

The donut hole is a temporary limit on what your Medicare drug plan will cover for your prescriptions. It began in 2006 when Medicare Part D plans became available and has changed over the years. It’s also known as the coverage gap. Here’s how it works in 2024:

- Initial Coverage: When you first start using your Medicare Part D plan, your plan helps pay for your covered drugs.

- Reaching the Donut Hole: After you and your plan spend $5,030 for covered drugs in 2024, you enter the donut hole. While in the donut hole, you’ll pay no more than 25% of the cost for brand-name and generic prescription drugs covered by your Part D plan.

- Catastrophic Coverage: This is the yearly “cap” on spending. In 2024, it’s $8000. Once you reach that amount in out-of-pocket spending, you don’t have to pay anything for covered medications for the rest of the year.

The elimination of the donut hole coverage gap in 2025 could save you a significant amount of money if your covered medication costs are high.

3. Medicare Prescription Payment Plan

The Medicare Prescription Payment Plan is another change that goes into effect in 2025. Starting in 2025, Medicare Part D participants can choose to use a payment plan option to spread out their payments during the year.

The payment plan option doesn’t change your total costs. It just spreads them out across a year’s time, which can ease the pressures on your budget if you rely on Social Security and other monthly income to pay for all your living expenses.There are no interest charges or fees to use the Medicare Prescription Payment Plan.

Prescription Payment Plan Example

For instance, if you know your out-of-pocket costs for covered medications will be about $333.34 each month and that you’ll reach the $2,000 cap on drug costs by June. If you choose the Medicare Prescription Plan Option in 2025 and spread that $2,000 over the full year, you would pay $166.66 a month for 12 months.

How the Changes Could Affect Your Part D Coverage

KFF, a nonprofit health policy research, polling, and news organization, explains that while the law lowers the out-of-pocket cap spending for Part D enrollees, it increases expenses for insurers and drug manufacturers. As the organization notes, the provisions of the Inflation Reduction Act require “requires Part D plans and drug manufacturers to pay a greater share of costs for Part D enrollees with drug costs in the catastrophic coverage phase (above the $2,000 spending cap) and reduces Medicare’s reinsurance liability.”

As a result, there are several ways the changes in Medicare Part D for 2025 might have an impact your Part D policy or your Medicare Advantage Policy that includes Part D coverage. The changes could affect the cost of premiums, the cost you pay for covered prescription medications, the tier level your medications fall into, and which pharmacies you can go to get your prescriptions filled. Medicare Advantage plans that include Part D might implement changes in non-drug related coverages as well.

As you review your Annual Notice of Change and compare it to other plans available to you, keep these facts in mind:

- Each plan has its own formulary (list of medications and dosages it covers.) You pay the full cost for any of your prescription medications that are not in your plan’s formulary.

- Your current plan could be making changes for 2025 in the medications it covers or the tiers your medications fall into.

- Each plan has its own pharmacy network, and may also have preferred and standard pharmacies in that network. Your out-of-pocket costs are generally lower at a plan’s preferred pharmacy than at a “standard” pharmacy in their network. If your current plan changes its pharmacy network, you may need to change where you have your prescriptions filled.

- Medicare Advantage plans that include Part D might make changes for 2025 in the benefits, the doctors you can see, preauthorization requirements or other parts of your plan for 2025.

- Your total costs with your current Part D plan or Medicare Advantage that includes Part D may be higher or lower for 2025. That’s why it’s so important to read the notice of change.

Get the Best Part D Drug Plan for Your Needs

It’s up to you to be sure your Medicare prescription drug plan will meet your needs in the coming year. Here are the steps to follow to evaluate and compare Part D plans:

1. Read the Annual Notice of Changes Your Plan Provided

Do it soon. If you don’t like your plan’s benefits for 2025, the only time you can switch a to a new plan is during the Medicare Open Enrollment period (October 15 through December 7) or if you have a Medicare Advantage plan, during the Medicare Advantage Open Enrollment period (January 1 through March 31).

2. Review of all the Medications You Take

Take note of whether or not your plan covered them in 2024. Review your premium costs, deductibles, if any, what tiers your covered prescription drugs fall into, what you paid (or what percentage of the price you paid) in 2024, and what pharmacies you used.

You should be able to find all of that information in your plan’s annual notice of change. If you don’t have a paper copy of the Annual Notice of Change, log into your plan’s website to get a copy.

3. Compare Part D 2024 and 2025 Costs

Your notice of change will show you any differences you’ll pay in premiums and difference in copays for different tiers of covered drugs in 2025. It should also state if any medications you take have been moved into a different tier, or if they are no longer covering a medication.

4. Review other details if You Have Drug Coverage through a Medicare Advantage Plan

If you got a notification of change from a Medicare Advantage Plan, you’ll want to look over all of the changes. Make sure your doctors and other medical providers are still in the plan. Look at the premiums, if there are changes in co-pays, deductibles, the need for preauthorization, types of coverage and other details in addition to drug cost coverage.

5. Compare Your Current Medicare Plan(s) to Others Available to You

If you aren’t satisfied with your current Medicare and Part D insurance, compare your benefits and costs to those of other providers. If you’re considering switching from original Medicare, Medigap and Part D to a Medicare Advantage plan that includes drug coverage, pay close attention to details such as what doctors you can see, what hospitals you can go to and the need for preauthorizations. Medicare Advantage plans are usually HMOs or PPOs that limit which medical professionals you can see. In addition, they may not cover you if you move or need non-emergency care while traveling in another part of the country from where you live.

6. Don’t Procrastinate

Remember: the only time you can change Medicare plans is from October 15th until December 7th during the Medicare Open Enrollment Period. So, don’t be tempted to put off reviewing your present plan. (Or, reviewing your parents’ plan if they’re relying on you for help.) Reviewing your present plan and comparing it to other options is going to take some time.

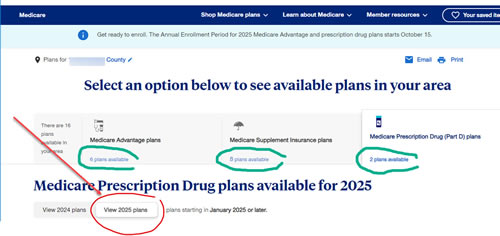

For instance, in my ZIP code in New York State, Medicare shows that there are 28 available Medicare Advantage Plans and 12 Part D standalone plans. If you click on each plan, you are shown multiple options.

Look at how many choices are offered by one insurance company alone:

Reading through those options and comparing them to options available from other Medicare insurance providers will take considerable time.

Be sure you’re looking at the details for 2025, too. As you can see from this screen shot, there are tabs for both 2024 and 2025 plan details.

What to Do When Medications Aren’t Covered by Your Plan

You have several options if you’re unhappy with the changes in your medication prescription plan.

- You can switch plans during the Medicare Open Enrollment Period

- Ask your doctor if there are alternative medications that are covered by your plan.

- If your prescription is for the generic version of a medication, ask your pharmacy if the name brand is covered by your plan. Surprisingly, there are some instances when plans cover the name brand of a drug instead of the generic.

- Ask your doctor to submit a request to your plan to cover your medication as an exception to their plan. (Unfortunately, requesting an exception doesn’t mean it will be granted.)

- If you are a veteran, look into prescription drug coverage that may be available to you through the U.S. Department of Veterans Affairs. Enrollment in the VA healthcare system is creditable coverage for Medicare Part D.

Related content: How to save on senior medication costs

Where to Search for Part D Alternatives

If you search online for terms like “compare Medicare Part D plans” or “best Medicare plans,” you may wind up on sites that exist soley to generate leads for healthcare insurance plans. They’ll ask you to enter a Zip code and contact information. But beware! Once you do that your information is likely to be distributed to multiple companies, and you’ll be getting a lot of unwanted phone calls.

A better way to look for plans is to go to the Medicare website and use their plan comparison tool.

What Can I Do if I Can’t Afford a Part D Plan

If you can’t afford to pay for Part D, you may be eligible for the Medicare Extra Help program. The program helps to pay for the monthly premiums, annual deductibles, and co-payments. Your eligibility will depend on your income and assets, among other things.

FAQs

Are You Required to Sign Up for Medicare Part D?

Most people are not required to sign up for Part D. Nevertheless, the marjority of people should sign up for it when they sign up for Medicare. The reason: unless you have creditable drug coverage (ie, drug coverage from an employer or other source that’s as least as good as Medicare Part D) you pay a penalty if you sign up late for Part D.

Do You Have to Change Medicare Plans Each Year?

No. If you are satisfied with your current plan and the changes the plan is putting in effect for the coming year, you can keep your current plan.

Do I Have to Do Anything To Renew My Current Plan if I Want to Keep It?

No. Your current plan will automatically renew if you don’t make any changes.

Do I Have to Apply for the $2000 Cap on Out-of-Pocket Medication Costs?

No, when you reach that threshold, you automatically get catastrophic coverage.

What is a Formulary?

A formulary is the list of prescription drugs your Medicare Part D plan covers. Not all plans cover the same medications. Before choosing or changing Part D coverage review the plan’s formulary to determine if your medications are covered.

What is the Medicare Annual Enrollment Period?

The Medicare annual enrollment period is the only time during the year when Medicare beneficiaries (i.e., anyone with Medicare) can review and change their health and prescription drug plan options or plans if they choose to do so. It is the only time during the year that you can change plans or switch from original Medicare to a Medicare Advantage plan, or vice versa.

When is the Medicare Annual Enrollment Period?

The annual enrollment period runs from October 15th to December 7th each year.

What in the Medicare Annual Notice of Change (ANOC)?

Insurers who provide Medicare Part D plans and Medicare Advantage Plans send out an Annual Notice of Change each September to alert you to cost and other changes that will take effect in your plan(s) in the new year. (Medigap / Medicare supplemental plans don’t send out notices because they usually don’t change.)

In addition to any changes in premiums, the Part D notice of change will let you know if the prescription drugs you take will still be covered, if they’re still in the same payment tier, and if there are any changes in cost or percentage of cost you have to pay.

The annual notice of change for Medicare Advantage plans will let you know about upcoming changes in premiums, deductibles, co-pays, and any changes to doctors and hospitals that will be in the plan’s network for the coming year.

If your Medicare Advantage plan includes Part D coverage, you’ll get one notice of change. If it doesn’t and you get Part D coverage separately, you’ll get two notices.

Why Do I Need to Read the Notice of Change?

Sadly, 7 out of 10 Medicare recipients never read the annual notice. And that’s a huge mistake. The notice tells you about changes that will go into effect on January 1 that may alter your premium costs, medication coverage, deductibles and other important aspects of your coverage.

The notice is sent early enough to give you time to review and compare plans and make a change (if you want to) during the Medicare Open Enrollment Period, which ends on December 7th.

If you don’t read the notice and don’t compare plans, you’re stuck for an entire year with whatever changes your current plan implements. That could cost you a lot of money and aggravation.

Are There Resources to Help Understand Medicare Part D Plans?

Navigating changes in Medicare Part D can be daunting, but numerous resources are available to assist beneficiaries during this transition.

The official Medicare website offers comprehensive information about coverage options, plan comparisons, and updates on the Annual Notice of Change. Local State Health Insurance Assistance Programs (SHIP) provide personalized counseling and support, helping individuals understand their specific situations.

Additionally, community organizations and senior centers often host informational workshops. Beneficiaries can also reach out to their insurance providers directly for clarification on changes. Utilizing these resources ensures that individuals make informed decisions about their Part D coverage and maintain optimal health care access.

Stay Informed Every Year

The changes in Medicare Part D make it critically important in 2024 to check the Annual Notice of Change for 2025. But policies, benefits, and options can changes in any year and could affect your healthcare options and costs . So, plan on reviewing your plan details each September when you receive the Annual Notice of Change.

Disclaimer: The information on this website is provided for informational purposes only and should not be considered as legal, tax, accounting, or medical advice. Please consult a licensed professional for help with any specific questions and issues you may have.

Leave a Comment

Your email address will not be published. Required fields are marked with *