When you’re turning 65, you have to sign up for Medicare health insurance and choose the best Medicare plan for your needs. To make an informed decision, your first step should be to learn how Medicare works. Once you understand the basics, you’ll need to evaluate your options and select the Medicare plan (or combination of plans) that’s best for your particular circumstances.

Whether you’re just signing up for Medicare or are already on Medicare but want to switch plans, you’ll find the information below helpful for choosing your senior healthcare insurance.

Two Options for Maximum Medical Cost Coverage

Most people are required to purchase Medicare at age 65. But Original Medicare Parts A and B only cover 80 percent of doctor and hospital fees. So, you’ll need other insurance to help protect yourself from catastrophic medical costs. There are two options to acquire that extra insurance:

1: You can choose Original Medicare and purchase a Medigap plan (to cover the 20% of hospital and medical costs that Parts A and B don’t cover) and a Part D prescription drug plan. With this option, you can receive care from any physician or medical facility in the United States that accepts Medicare. And usually won’t need prior-authorizations. Prescription drug coverage will depend on the Part D plan you choose.

2: You can purchase an “all-in-one” Medicare Advantage plan that, in effect, combines Part A, Part B and Medigap-type coverages. They often, but not always, include drug coverage.

Despite being “all-in-one” plans, you still have to apply for Medicare and pay for Part B to be eligible to get a Medicare Advantage plan. In addition, to receive the full benefits under a Medicare Advantage plan, you may be restricted to using only the doctors and medical facilities in the plan’s network. You may also need prior-authorizations for some testing or to see specialists. If the Medicare Advantage plan you choose doesn’t offer drug coverage, you may not be able to get a separate Part D plan without switching to Original Medicare.

Medicare Plans Can Only be Changed Once a Year

Once you choose an option, you have to stick with it for the calendar year. If you discover the plan doesn’t meet your needs, you have to wait for an Annual Enrollment Period to change your plan. The Medicare Annual Enrollment Period starts each year on October 15 and ends on December 7. During that time you can change Medicare Advantage plans, Medigap and Part D prescription drug plans. Medicare Advantage Plan enrollees have a second open enrollment period that runs from January 1 to March 31. During that time frame, they can either switch Medicare Advantage plans or switch back to Original Medicare. Switching back could make it difficult to find supplemental insurance, however.

Where to Find Medicare Plans Available to You

The best place to start gathering information about your options is with the Medicare.gov website plan comparison tool. The Medicare.gov site lets you get plan information without having to talk to an insurance agent until you want to.

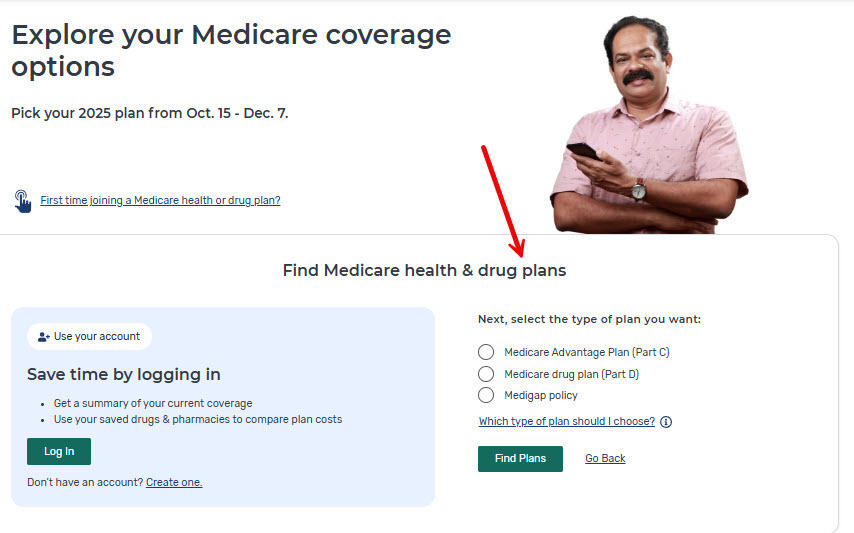

Once you enter your zip code, you get taken to a page like this that lets you choose the type of plan you want to investigate.

Choose the type of plan you want to look at and click Find Plans.

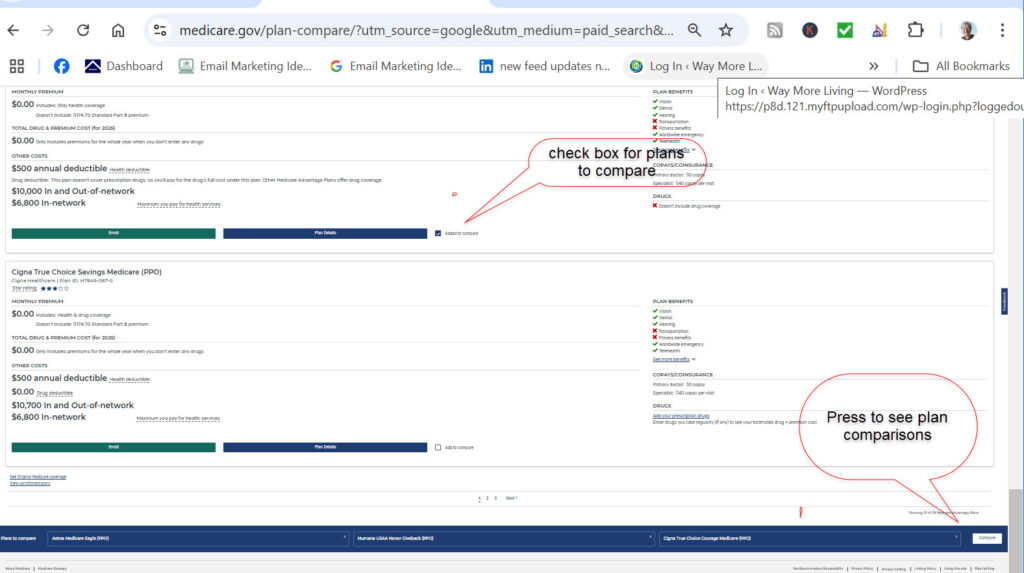

You’ll be asked to answer a couple of questions. When you answer the questions, Medicare.gov will display a list of plans that are available in your location. The list will give you information about premiums, deductibles, in- and out-of-network costs (for Medicare Advantage plans), medication costs (if you listed your medications), and plan benefits.You can get more information about any of the plans by selecting the Plan Details button.

Here’s an example of Medicare Advantage plans available in a certain location:

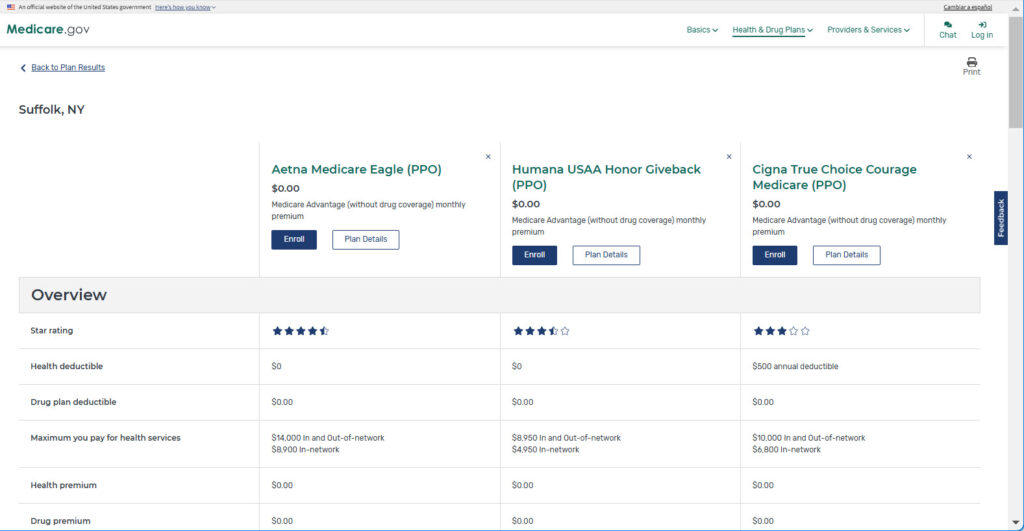

If you want to compare costs and benefits of two or more plans, click the compare box for each plan you want to consider, then scroll down the page and choose the Compare button on the bottom right. Medicare will then show you the details of the plans you selected side by side, making it easier to see differences and similarities that matter to you.

After you’ve looked at one type of plan, you can go back to the find plans page and choose other plans to look at. For instance, when you’re done looking at the Medicare Advantage plans, you might want to go back and see what it would cost you to get a Medigap plan plus a Part D plan instead.

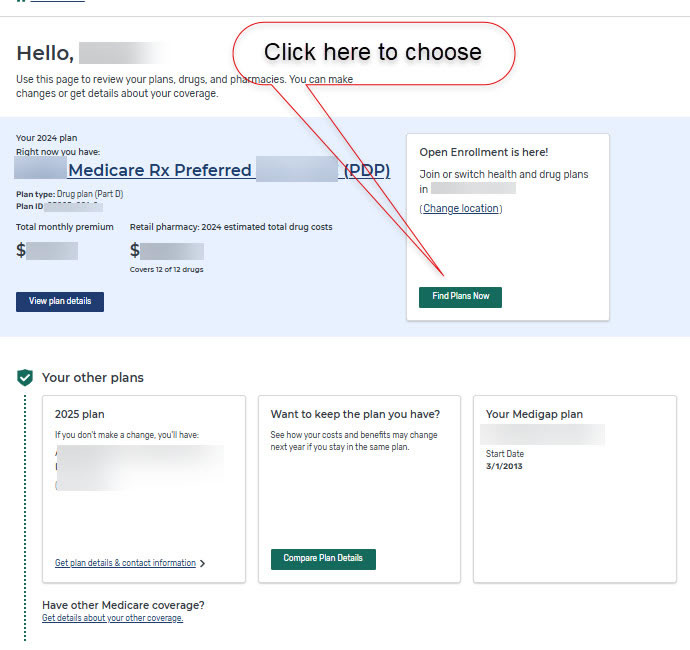

Finding Alternative Plans for your Existing Medicare Plan

If you are already on Medicare, you can sign in to the Medicare site to see your options. When you sign in, Medicare will take you to a page that shows you your current plans and pricing. If you want to find other plans to compare, click the Find Plans button. That will take you to the same plan comparison options described above.

Making Your Decision

The information on the Medicare site will give you most of the details you need to make a choice. But there are additional things you need to consider.

For most people, the cost of insurance premiums and total out-of-pocket costs is a major consideration in choosing the right healthcare plan once you reach 65. But cost shouldn’t be your only consideration.

Your choice of doctors, location of services, types of medications you require, and feelings toward needing prior authorization for procedures or to visit specialists are important considerations as well. You also should consider what kind of costs you might incur should you have a serious accident (a fall and broken hip, for instance), might need major “elective” surgery (i.e., total knee replacement), or develop some serious ongoing medical condition.Those types of medical needs become increasingly prevalent as we age.

Are Your Doctors in Network?

With Original Medicare and Medigap you can see any doctor or health facility that accepts Medicare. But with Medicare Advantage Plans, your plan benefits depend on whether or not the doctors and hospitals you use are part of the plan’s network.

Thus, if you are leaning toward choosing a Medicare Advantage plan, you need to find out if your doctors are part of their network. You can do that by going to the plan’s website and looking for a directory that lists the doctors that are part of the plan. Or, you can contact your doctors and other medical providers directly and ask them if they participate in the network of the Medicare Advantage plan(s) you are considering.

You also need to consider your lifestyle. Medicare Advantage plan networks are often regional. If you need ongoing treatment when you’re out of your home location (say you spend winters in the south), your plan may not cover your expenses.

Related content: Who’s treating me? – Medical designations explained

Choose Wisely Based on Your Needs

Ads for Medicare Advantage plans that tout low premiums or extra benefits such as dental or eyeglass coverage, free gym memberships, or an allowance toward over the counter drugs can be appealing. And a plan like that might possibly be the best choice for you.

But, like so many other things, the devil is in the details—details that aren’t discussed in commercials.

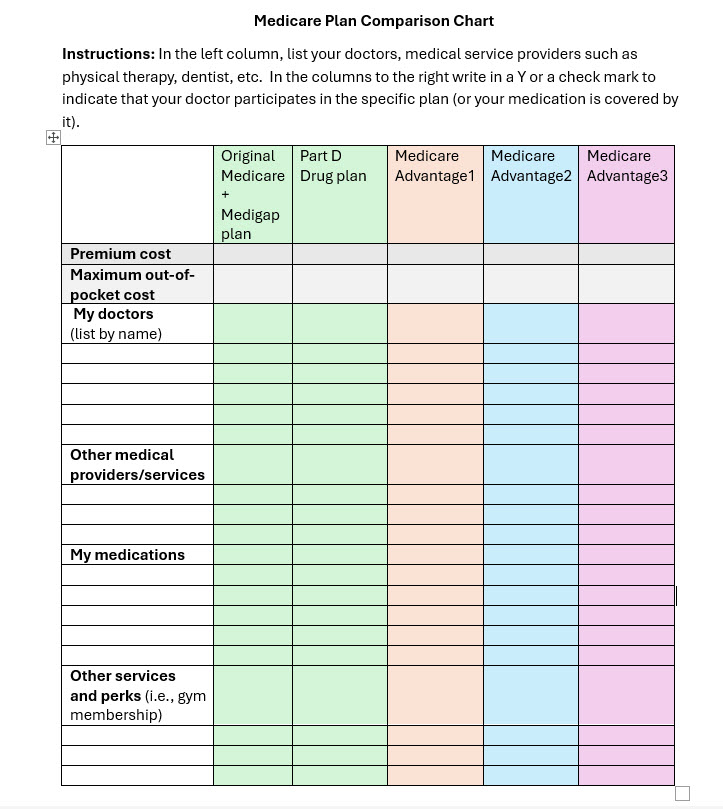

Before choosing or switching plans, carefully compare your options. Create a chart like this for yourself so you can compare plans based not only on cost but also by whether the doctors and services you need will take the insurance you plan to buy.

Where to Get Help Choosing a Medicare Plan

You can get help from Medicare by calling 1-800-MEDICARE (1-800-633-4227). Or, you can live chat with Medicare at Medicare.gov/talk-to-someone.

You can also get free help with evaluating your Medicare options from the State Health Insurance Assistance Program (SHIP).

Disclaimer: The information on this website is provided for informational purposes only and should not be considered as legal, tax, accounting, or medical advice. Please consult a licensed professional for help with any specific questions and issues you may have.

Leave a Comment

Your email address will not be published. Required fields are marked with *