Running out of money in retirement is something no one wants to think about. But it’s a reality that’s already reaching crisis proportions for millions of Americans aged 65 and up. As the population ages, so too will the numbers of seniors who run out of money in their golden years.

You, a friend, or a family member could be one of them. Here are the statistics and things to consider to beef up and stretch your retirement savings.

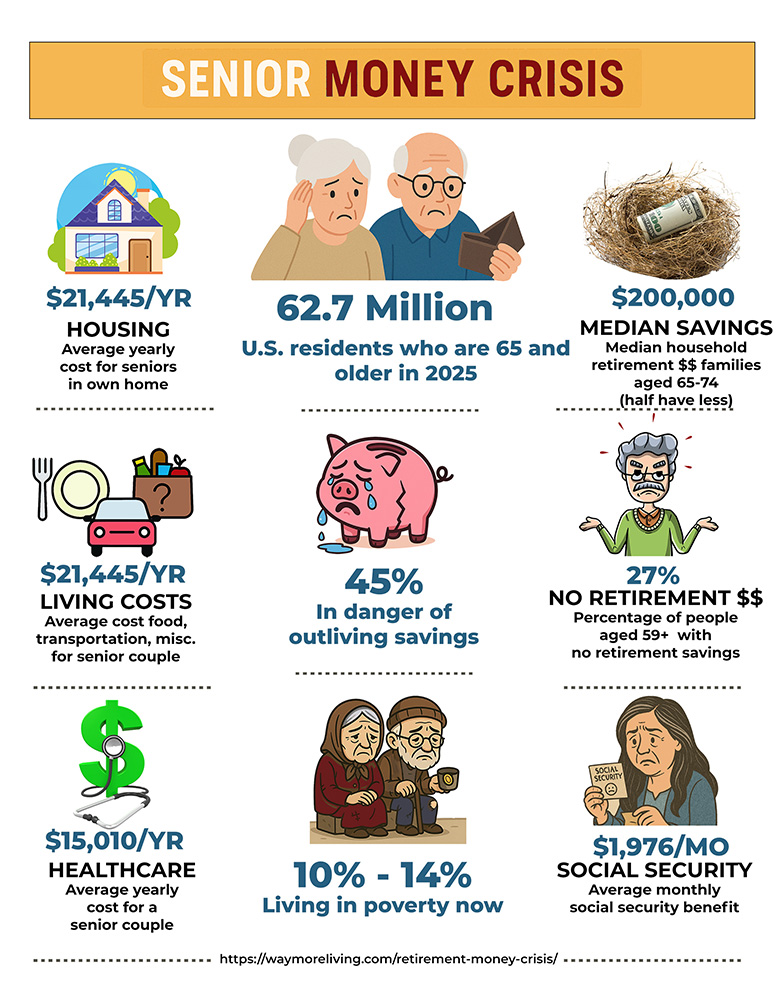

Senior Finances: The Statistics Are Scary

Recent statistics show how few people have enough retirement savings tucked away.

A study by the Morningstar Center for Retirement & Policy Studies indicates that 45 percent of U.S. retirees “will run short of money in retirement.”

That statistic is particularly frightening when you consider how many millions of people will be affected.

According to S&P Global, there are 62.7 million people who are 65 and older in the U.S. today. That number is expected to reach 71.6 million by 2030.

If the Morningstar report is correct that 45 percent of retirees will run short of money, in the years following 2030 there could be more than 32 million seniors who won’t have enough money to live on.

The Retirement Money Crisis Has Begun

Running out of money in retirement isn’t just a prediction of what retirees can expect in the future. As of 2022, between 10 and 14 percent of people aged 65 were living in poverty.

The U.S. Federal Poverty Guidelines used to determine financial eligibility for certain programs puts the poverty level at $21,150 for a family of 2 in 2025. But that number sounds out of touch with reality. In many areas of the country, people who earn much more than that are impoverished.

For example, United for Alice data shows that in Texas, the survival budget for a single individual 65 years old or older is $31,032. It climbs to $37,056 in New York. (A survival budget considers the bare minimum amounts to cover the cost of basic necessities such as housing, food, transportation, healthcare, and technology needed for a household to survive.)

Why Seniors Are Running Out of Money

There are numerous factors that put so many seniors on shaky financial ground. Here are some of the biggest:

Financial Illiteracy

Many people simply don’t understand finances. The World Economic Forum reports that only about 50% of the people in the US are financially literate. They don’t have the skills or knowledge to effectively plan, budget, invest and manage their money. They’ve never learned about money management in school, looked it up on the Internet, or learned from family or friends.

Little or No Retirement Savings

Unfortunately, many people have little or no retirement money saved as they near or reach retirement. Some don’t plan ahead. Others, due to low income, high cost of living, or catastrophic expenses, have little or no money to put away for the future.

An AARP survey conducted in 2024 found that 20 percent of people aged 50 and over had no retirement savings at all. A 2023 Credit Karma study found that 27 percent of people 59 and older have no money saved for retirement.

Statistics about how much money 65-year-olds have saved as they enter retirement vary somewhat depending on the source. Data from the Federal Reserve 2022 Survey of Consumer Finances shows that the median household retirement account balance for people aged 65 to 74 is only $200,000.

(The “median” is the midpoint – half of the people have more, half have less. Thus, there are millions of people whose savings fall far below $200,000 at retirement.)

Given today’s high cost of living, $200,000 in retirement savings doesn’t stretch very far, even when members of the household are receiving Social Security.

Underestimating Retirement Medical Costs

Medical costs are one of the biggest expenses in retirement. The Bureau of Labor Statistics (BLS) reports that in 2022 retirees spent an average of $7,505 each a year on healthcare. (Costs are likely to be higher now.) According to the 2024 Fidelity Retiree Health Care Cost Estimate, a 65-year-old may need to spend at least $165,000 to cover medical expenses through the duration of their retirement. Thus, a retired couple may need $330,000 of their nest egg to cover insurance premiums, deductibles, prescription medications, and other out-of-pocket medical expenses during their retirement.

The cost can be even higher for people who live well past 80 and need daily care. Data from A Place for Mom show the median cost for in-home care in 2024 was $30 per hour. In some locations, that price increased to $40 to $50 an hour.

Underestimating Housing Costs

- The cost of housing for renters and homeowners, which averages $21,445 for seniors, can be burdensome. An Administration for Community Living (ACL) report has found that 45% of older households spent one-third or more of their income on housing costs. (ACL is an operating division of the U.S. Department of Health and Human Services.)

- Independent living communities, assisted living and continuing care communities can cost $37,000 to $60,000 a year or more, depending on services needed. Some also have a steep “buy-in” cost to join.

Related reading: Senior Living Options

Ignoring Other Daily Living Costs

Besides the big expenses for healthcare and housing, it’s important to plan for costs of food and miscellaneous purchases during the month. Those costs vary by location, home ownership and one’s health. Elder Index, a helpful planning tool published by the Gerontology Institute at UMass Boston, shows the average costs of living by location in the county. Their data puts the cost of food, transportation, and miscellaneous purchases at a total of $1,722 per month for a senior couple living in Suffolk County, New York. Their data shows the average cost of housing and healthcare costs, too.

Inflation

- The cost of living keeps going up. It increases what you need to spend on a new car, car insurance, food, clothing, entertainment, and everything you buy. In planning your retirement money needs, you need to calculate the effect of inflation.

- As an example, assume the inflation rate averages 2.5 percent a year. If you’re spending $200 a week on food and grocery items, you’ll need $327.72 for the same items 20 years from now. If your current monthly living costs are $6,500 now, you’ll need $10,651 in 20 years to cover the same monthly expenditures.

Expecting to Live on Social Security

Although Social Security beneficiaries get cost-of-living increases, most people need far more money every month than the Social Security benefits they receive.

In January, 2025, the average Social Security benefit was only $1,976 a month ($23,712 a year). Meanwhile, according to the Bureau of Labor Statistics, the average annual household expenditures in 2022 was $54,975. Even with two people earning that average Social Security benefit, there would be a shortfall.

Forgetting About Income Taxes

- Stopping work doesn’t mean you’ll stop having to pay income taxes. You will be required to pay income taxes on the required minimum distribution from your retirement account, on any dividends and interest you receive from other investments, and on other sources of income. Depending on your income, between 50 and 85 percent of your Social Security benefits may be taxable.

- That amount can be sizable. According to a Bankrate tax calculator, in 2024, the federal tax bill for a married couple, both 65 years old or older, with a joint income of $100,000 and no itemized deductions, would be over $8000. Depending on the location, there’d be state income taxes due as well.

Financial Abuse

Sadly, retirees are often the victims of elder financial abuse and fraud. Dishonest family members, “friends,” and fraudsters who target lonely seniors are among the scumbags who steal from or scam seniors out of their retirement savings. The results are devastating.

Longevity

People are living longer, too. In the year 2000, the average life expectancy in the U.S. was 76.47. Today, according to the Social Security Administration’s Life Expectancy Calculator, someone turning 65 can expect to live to about 80 years of age. There are many people who live much longer than that, too. Thus, bigger retirement nest eggs are needed to avoid running out of money as you age.

What the Senior Money Statistics Mean in Real Life

Statistics about senior savings — or lack of savings — tell us the scope of the problem. But they don’t provide any insight into the lives of the people who make up those statistics.

But social media does.

Browse through social media groups on Facebook or elsewhere that retirees gather, and you’ll find numerous posts from seniors who are having difficulty making ends meet or who’ve been advised they’re going to run out of money in a few years.

You’ll also see posts from people who are in their late 70s or early 80s and must keep working because they need the money. Then there are the people who need to move in with family because they don’t have the money to live elsewhere.

How Much Money Do You Need to Retire?

The ways to address your own needs for money in retirement will vary depending on many factors, including whether you’ve already retired. But no matter what your current circumstances are, you need to get an accurate picture of what lies ahead.

Estimate Your Retirement Savings and Income Needs

The actual amount of money you’ll need to live comfortably in retirement depends on things like what you deem to be “comfortable,” along with things like your overall health, how long you live, what part of the country you live in, what the stock market does, and whether you’ll need any type of medical or other assistance. Some of those things are predictable. Some aren’t.

There are a variety of guidelines for predicting your retirement savings needs. T.Rowe Price suggests that people who retire at age 65 should have assets equal to between 7 ½ and 13½ percent of their preretirement income. Citizens’ Bank suggests 10 to 12 percent as one way of estimating the amount. Other methods they suggest include the familiar 80%” rule.” That rule assumes your yearly retirement income needs will be about 80 percent of your work income.

All of those suggestions are just starting points. They are generalizations that don’t account for individual circumstances or how costs and needs may change over time.

Here’s a potentially better approach to estimate your personal money needs in retirement:

1 – List your expected retirement living costs

Your estimate should include daily expenses such as housing, food, transportation, healthcare, insurance premiums, leisure activities, and any unexpected expenditures that may arise.

2 – Factor in Inflation

As discussed above, prices will rise over time due to inflation; therefore, it’s crucial to account for this when estimating future expenses.

3 – Determine Your Income Sources

Identify various income streams you’ll have during retirement. Depending on your circumstances, these may include Social Security, required minimum distributions from your IRA or other retirement plans, pensions, and annuities. Calculate the total contribution those income sources will make towards meeting your monthly expenses.

4 – Calculate the Gap

Subtract your expected income from your estimated monthly expenses. This will tell you how much additional money (if any) you’d need available to withdraw from savings and investments.

What If You Haven’t Saved Enough for Retirement

If you’re 55 or older and don’t have much saved, the stakes are high. Social Security alone probably won’t be enough to cover your needs, especially with rising healthcare costs and inflation taking bigger bites out of fixed incomes.

What can you do?

Delay Your Retirement and Social Security Benefits

Consider delaying retirement and delaying when you start taking Social Securitybenefits if you can. Working and putting off Social Security for even just a few extra years can make a big difference. Not only do you avoid tapping your savings, but you also give yourself more time to contribute to them. Plus, every year you delay claiming Social Security past your full retirement age boosts your benefit by about 8% until age 70. That’s a guaranteed return most investments can’t match.

Take Advantage of Catch-up Contributions if You’re 50 or Older

Catch-up contributions are a form of retirement plan contribution that lets people 50 and older contribute more to their plan each year than the standard contribution limit. How much extra you can contribute varies between $1,000 and $7,500 for 2025, depending on the type of retirement plan you have.

Rethink Your Lifestyle

Downsizing your home, moving to a lower-cost area, or cutting unnecessary expenses can stretch your dollars further. Seniors who are mindful about spending can find many ways to cut costs and save money without greatly impacting their daily lives.

Look for Sources of Extra Cash

Even if you’ve already retired, getting a part-time job or doing some freelancing can be helpful. Going back to work full-time might be something else to consider. You might be able to find remote jobs (jobs you can do from home.)

How much you’re allowed to earn if you’re collecting Social Security

If you’ve already retired and are at or beyond full retirement age, you can earn as much as you want without your Social Security benefits being reduced. But if you are collecting Social Security and haven’t yet reached full retirement age, your benefits will be reduced if you earn more than $23,400 a year. If you earn more than that amount, $1 of benefits will be withheld for every $2 earned over $23,400.

Rent Out a Spare Room

If you have a spare room in your house, renting it out could create extra income. Before you offer it for rent, though, be sure to check on zoning laws and other regulations in your area. Also consider the impact of having someone else living under your roof.

Consider a Reverse Mortgage

If you’re running short of retirement money and own your home, another potential source of cash is a reverse mortgage. A reverse mortgage lets you take advantage of the equity in your home without having to sell your house. Reverse mortgages can be advantageous for some people, but be sure you know both the risks and benefits of a reverse mortgage before you talk to any reverse mortgage providers.

Talk to a Professional

A meeting with a professional financial advisor — preferably one who charges by the hour and doesn’t sell products — can help you see where you stand and what moves make the most sense. You might qualify for programs that reduce healthcare costs or property taxes. Planning isn’t just for the wealthy. It’s a tool anyone can use to stay afloat—and stay in control—through retirement.

Research any financial advisor you plan to speak with to ensure they are well-known and have a solid reputation. Ideally, the person you speak with should be a fiduciary. Fiduciaries have a legal obligation to make recommendations based on your best interests. Steer clear of people promising you higher than normal or faster than normal returns on your money.

Protect Your Savings from Scammers

Retirement savings are prime targets for fraudsters. Scammers They try to access seniors’ money by tricking them into clicking links in emails or on the web. They also make phone calls pretending to be a relative in need or some charitable organization. Help protect yourself by implementing online banking safety procedures and being on guard against fraudsters who contact you by phone with urgent requests of demands for money.

Don’t Ask for Money Advice on Social Media

Posting questions to social media about how to have enough money to retire can put you on the radar of scammers. You cannot be sure if the people on social media, who aren’t already part of your real-world friends and family, are genuine.

Even if you know the people personally, be careful about their advice. If they’re not financial experts, their money advice is likely based on their personal preferences, gossip, or a pyramid scheme they’ve fallen for.

Related: Avoiding Disaster and Price Gouging Scams

Act Now for a More Secure Retirement

Don’t bury your head in the sand. Take steps now to shore up your finances. Following the steps above and getting professional advice (if needed), can help you craft a plan tailored for your retirement needs and timeline.

Disclaimer: The information on this website is provided for informational purposes only and should not be considered as legal, tax, accounting, or medical advice. Please consult a licensed professional for help with any specific questions and issues you may have.

Image sources:

Cartoon lady with piggy bank and several icons in the infographic: Istockphoto

Other images created with ChatGPT

Leave a Comment

Your email address will not be published. Required fields are marked with *