Financial abuse isn’t something we expect to happen to us as we age. We anticipate that family members and other people we deal with will be trustworthy and honest, and that our belongings will be safe. Sadly, things aren’t always like that.

In the twelve-month period between June 2022 and June 2023, the Financial Crimes Enforcement Network (FinCEN) received 155,415 reports of elderly financial exploitations associated with more than $27 billion in reported suspicious activity. (FinCEN is a bureau of the United States Treasury).

Although the cash figure is startling, what’s even more concerning is that these exploitations don’t target random organizations or super-rich individuals. The victims are vulnerable elders who depended on the money they lost to survive. They are from your county as well as from other small and large cities.

Sometimes fraudsters con them out of a few thousand dollars. In some cases, they lose tens of thousands or hundreds of thousands of dollars to phony investment schemes. Additionally, they occasionally become the victims of callous and dishonest relatives who gain access to their savings. Whatever the cause, the losses may have severe psychological and financial repercussions, leaving little or no money for retirement.

We created this guide to assist you in defending against elder financial abuse and exploitation for both you and your loved ones. Find out what elder financial exploitation is, how it usually happens, how to stop it, and what to do if you believe that a loved one or you, yourself, are being taken advantage of financially.

What is Financial Abuse of Seniors?

Financial abuse of seniors, also known as elderly financial exploitation, involves the improper or illegal use of an older person’s funds, property, or assets. This type of abuse can range from simple theft to intricate con games and scams.

According to the Financial Crimes Enforcement Network (FinCen):

- Elder theft involves the theft of an older adult’s assets, funds, or income by a trusted person.

- Elder scams involve the transfer of money to a stranger or imposter for a promised benefit or good that the older adult did not receive.

The abuse may involve manipulating or exerting pressure on an older person who may not understand the consequences of certain financial decisions or who feels pressured and unable to defend themselves.

Examples of Elderly Financial Abuse

Here are a few ways that abuse takes place:

Misuse of funds: Without consent, a familiar and trusted caregiver, relative, or friend takes advantage of the senior’s money for their own gain.

Forced changes to legal documents: Pressuring or tricking a senior into changing a will, power of attorney, or beneficiary designations.

Investment scams: Seniors are targeted with fictitious investment “opportunities” that cause large financial losses.

Telemarketing and internet scams: Deceptive tactics used to trick or pressure seniors into revealing personal information or sending money for for fictitious goods or services.

Emergency scams: Fraudsters call claiming there’s an emergency need for money. They may say a grandchild’s been arrested and needs bail money, or site some other type if emergency. Then they ask for cash to be transferred or for gift cards to be purchased and the card numbers read to them. But none of it is true.

Deceptive billing: Charging or invoicing seniors for unnecessary or overpriced services.

Why Are Senior Citizens Targeted?

There are several reasons why con artists and robbers prey on the elderly. Among these are:

- Cognitive Decline: People may have cognitive losses as they get older, which can make it more difficult to spot exploitation and handle finances.

- Isolation: A lot of elderly people live alone or are socially isolated, which makes them more vulnerable to abuse. The abusers pretend to be in love with them or become friends with them. After they’ve gained the senior’s trust, they begin requesting money.

- Wealth Accumulation: Because older people frequently have more savings, assets, and real estate than younger adults do, they are prime prey for financial predators.

- Dependence: Seniors who depend more on others for support and care may be more susceptible to manipulation or coercion.

Signs of Elder Financial Abuse

The first line of defense for loved ones against financial abuse is understanding its warning indications. Typical indications consist of:

- Unexplained withdrawals: Significant, recurring, or mysterious withdrawals from bank accounts; adjustments made to banking procedures.

- Changes in estate documents: Sudden alterations in wills, trusts, or powers of attorney.

- Unpaid bills: Even with sufficient wealth, the elderly person may have delinquent bills or their utilities possessions: Priceless items like jewelry, artwork, or money might vanish without leaving a clear trail.

- Secrecy or anxiety about finances: Seniors may exhibit dread when discussing finances or abruptly stop talking about them.

Most Likely Perpetrators of Financial Abuse

Anyone with access to a senior’s financial affairs is a potential source of financial abuse, including:

- Family members: The people who take advantage of trust and accessibility are frequently the ones closest to the elderly, such as adult children or grandkids

- Caregivers: People in home care settings and professionals alike might take advantage of their trusted status to obtain financial benefit.

- Scammers: Scammers who target elders particularly with phone, postal, or online fraud are examples of external parties.

- Legal and financial advisors: People entrusted with providing advice on legal or financial issues occasionally exploit their positions for personal benefit.

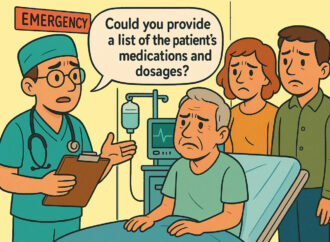

What to Do if You Suspect Financial Abuse

If you suspect that an elderly person (or you, yourself) is a victim of financial abuse, take immediate action:

- Discuss the issue: If you believe an elderly person is being targeted for their money, approach the person in a tactful way to learn their perspective and gather information. If you think you’re the one being targeted, don’t be embarrassed or ashamed. Protect yourself by getting details and discussing the issue with someone who is trustworthy before you give or send money.

- Document the evidence: Keep records of all suspicious activities, including dates, times, amounts, and descriptions of incidents.

- Report the abuse: Contact local Adult Protective Services. They serve older adults and adults with disabilities who need help due to abuse, neglect, or exploitation. Adult Protective Services is a common term, but this may not be the name of the agency in your state. Find your local APS .

You can also call the police, or financial institutions to begin an investigation. - Get legal advice: A lawyer specializing in elder law can provide guidance on how to protect the senior’s assets and take legal action if necessary.

What Information Do You Need to File A Report?

The Consumer Financial Protection Bureau says to include as much information as possible in your report. Share whatever you have observed, including as many of these details as you can gather:

- Time, date, and location of the incident(s)

- Names of anyone who was involved and anyone who observed the incident(s)

- Description of the suspected financial abuse and any other types of abuse or neglect

- Your loved one’s disabilities or health conditions, including any information about decision-making abilities or memory loss

- Whether you believe there is an urgent risk of danger to your loved one or someone else

Laws and Penalties for Elder Financial Abuse

Elder financial abuse is covered by a number of state and federal statutes that highlight how severe this crime is. Penalties may include jail time, fines, and restitution. Frameworks for criminal prosecution and civil action against offenders are provided by laws like the Elder Justice Act and other state-specific acts.

In addition, professionals who work in fields such as banking and healthcare are frequently mandated by law to disclose any suspicions of abuse, which helps to notify authorities about possible exploitation.

Furthermore, professionals like bankers and healthcare providers are often required by law to report suspected abuse, ensuring that authorities are alerted to potential exploitation.

In Summary

Elder financial abuse is a serious issue that calls for alertness, understanding, and preventative actions. Protecting our elderly against financial exploitation requires an understanding of what financial abuse is, how to spot it, and how to act. We can contribute to ensuring our loved ones’ golden years are safe and secure by being aware and ready.

Disclaimer: The information on this website is provided for informational purposes only and should not be considered as legal, tax, accounting, or medical advice. Please consult a licensed professional for help with any specific questions and issues you may have.

Leave a Comment

Your email address will not be published. Required fields are marked with *